Stack’s Bowers Galleries

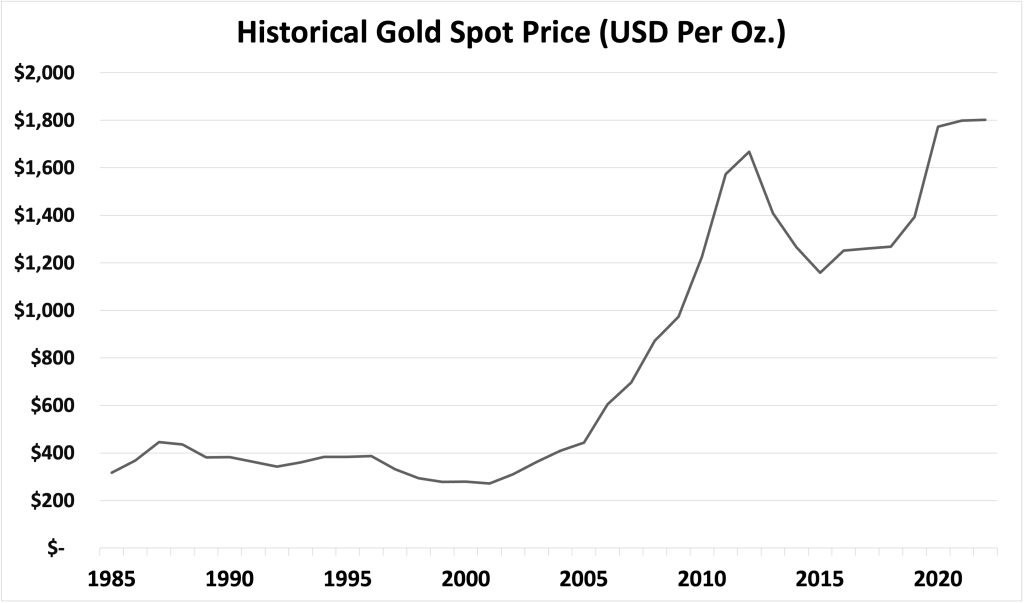

Melt Value Calculator

| This page is intended for melt value purposes only. Coins are often valued based on their date, mintmark, condition and other factors. The values shown here represent the silver or gold value of a coin, and not their potential market value. To learn more about the actual value of a coin you own, please contact our experts at info@stacksbowers.com. |

Gold, the soft, lustrous, yellow precious metal, has been sought and treasured by humankind since ancient times. The Greeks found it in riverbeds in Asia Minor and used it to craft some of the world’s first coins, those struck more than 2,600 years ago by King Croesus of Lydia.

The Egyptians brought gold down the Nile from Nubia, and both the Roman and Byzantine empires struck magnificent gold coins that are prized by today’s collectors. Across the Atlantic, the ancient American Indian civilizations of Mexico, Peru, and Colombia fashioned exquisite ornaments from the yellow metal they called the Tears of the Sun.

Gold coinage returned to Western Europe in the late Middle Ages with great international coins called the Florin and Ducat. For centuries, governments and peoples have esteemed gold as a universal store of value, a primary source of portable wealth, the gleaming standard against which the value of all other things could be reliably measured.

The supply of gold is limited, and no more than 200,000 tons of the precious metal have been produced in all human history. A single cube measuring 69 feet on one side would contain all the gold ever mined. Demand for gold has steadily increased in recent years for jewelry, coinage, electronics, and dentistry. Although production has increased, demand has always outstripped it and gold is as rare today as ever.

Leading nations abandoned gold coinage after the First World War, but the revolution, runaway inflation, economic and political upheavals that followed reinforces gold’s importance in the economic discipline of governments. Today, as in past years, “as good as gold” holds true for governments as well as individuals.

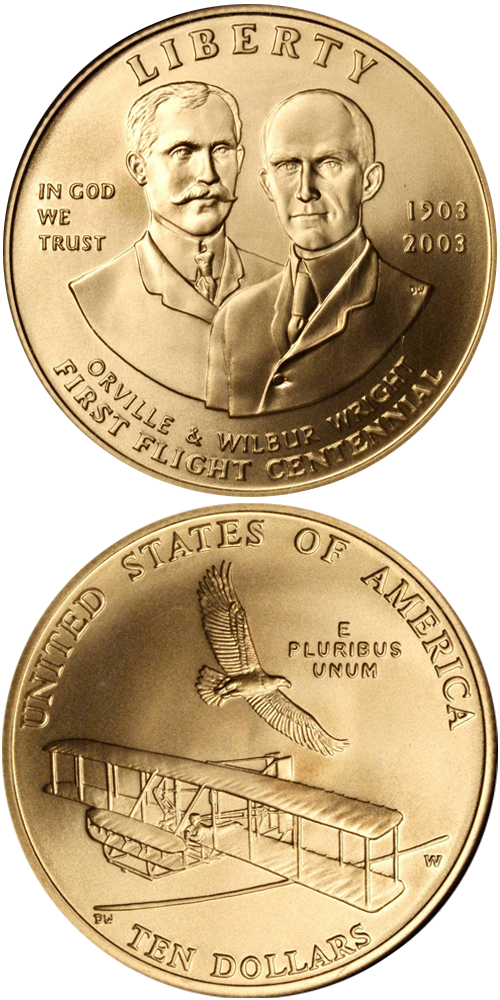

Today, gold coins are in demand all over the world. Classic older issues, modern commemoratives, and newer bullion gold coins are eagerly sought by collectors and investors. Older issues generally offer a numismatic premium as recognized collectibles. Modern bullion coins provide a convenient method of acquiring gold in standardized Troy ounces and fractions. Gold coins make unique and highly treasured gifts as well as valuable additions to a collection or portfolio.

Stack’s Bowers Galleries offers a wide selection of United States and world gold coins, enumerated below, each with detailed specifications listed below the coin. We invited you to look through these coins, and we would be happy to answer any questions you may have.

Popular United States Gold Coins

The American gold Eagles were authorized by the United States Congress in 1985 and began production in four different weights in 1986. The obverse of the coin features Augustus Saint-Gaudens famous Liberty design, walking forward in front of the Capital Building. In 2021, the reverse design changed from nesting eagles to a bold, heroic bust of an eagle. In 2006, the United States government unveiled its newest bullion coin, the American Buffalo. Its design was based on the previous Buffalo nickel design, and the coin was minted in 0.9999 fine gold, as opposed to the 0.9167 purity of the American Eagle.

Return to the top of the page.

Popular Australian Gold Coins

The Australian gold Kangaroo is the most enduring gold bullion coin from Australia. While the country also produced gold Nuggets, gold Koalas, and gold Lunar coins, the Kangaroo series has become synonymous with Australian bullion. The production of these coins began in 1986 as a gold Nugget, and changed to Australia’s iconic animal, the Kangaroo, in 1990. After the change in design, the coin rapidly gained popularity. Now, the coin’s design is revised each year to feature a new depiction of the national animal. What makes this coin desirable to bullion collectors is its amazing purity – 0.9999 fine gold, in contrast to some other coins on the market that only boast 0.999 or 0.9167.

Return to the top of the page.

Popular Austrian Gold Coins

The Austrian gold Philharmonic was introduced in 1989 as an ode to the arts and culture of the nation. Originally, the coin was only offered in two weights: one ounce and quarter ounce. The design pays tribute to the Vienna Philharmonic, one of the finest orchestras in the world. From 1989 until 2001, the coin was valued in Austrian Shillings, the nation’s currency at the time. Beginning in 2002, the value of the coin was shown in Euros following the adoption of the European Union’s common currency. The Philharmonic is the main bullion coin for Austria, but the country still produces commemorative bullion coins to satisfy the needs of collectors, much like the United States.

Return to the top of the page.

Popular Canadian Gold Coins

The Canadian gold Maple Leaf was the second bullion coin to be introduced, making its debut just a few years after the South African Krugerrand. The Maple Leaf always features the British monarch on the obverse, regardless of which metal it is struck in. The reverse of the coin shows the country’s Sugar Maple leaf, a motif that has only been changed to include security features like lines and privy marks. From 1979 to 1981, the coin was minted in 0.999 fine gold. Beginning in the latter half of 1982, the coin’s purity was increased to 0.9999 fine gold. Canada continues to mint various gold bullion pieces featuring different designs. This coin, though, is the most recognizable amongst them.

Return to the top of the page.

Popular Chinese Gold Coins

Since its beginning in 1982, the Chinese gold Panda program has become one of the most popular bullion coins on the market. Each year, the image of the Giant Panda is reinvented to give collectors a new, intriguing item to purchase. Only once, in 2002, did the design remain the same, much to the dismay of collectors. The coin is offered in plenty of sizes to accommodate all budgets, ranging from 5 ounce and kilo coins, all the way down to 1/20 troy ounce and 1 gram coins. 2016 marked the first year that gram weights were used exclusively, in a switch from the previous troy ounce measurements.

Return to the top of the page.

Popular British Gold Coins

First produced in 1987, the Great Britain gold Britannia is the official bullion coin of the United Kingdom. The coin was originally produced in 0.917 fine gold, but was changed to 24-karat pure gold in 2013. The coin’s obverse features a depiction of the British monarch and is occasionally updated with a newer portrait. Just like some other countries, the reverse design of Britannia will typically change from year to year. The Royal Mint has been known to add interesting details like privy marks and new symbolic lettering to commemorate certain events. The Mint has continued to update the coin to deter counterfeiting, including adding a radial sunburst.

Return to the top of the page.

Popular Mexican Gold Coins

The first Mexican gold Libertad coins were struck in 1981 in three weights: 1 ounce, 1/2 ounce, and 1/4 ounce. After a successful first year mintage, the government did not produce another coin until 1991 when it also added 1/10 ounce and 1/20 ounce weights. Production of the coins continued until a halt in 1995, this time lasting five years. These original strikings were in 0.900 fine gold. When production of the coins resumed in 2002, the purity was increased to 0.999 fine gold. While there are other gold coins being produced by the Mexican Mint, the gold Libertad has risen to the top in terms of popularity. The Mint now offers Proof and Reverse Proof striking of the coins as well.

Return to the top of the page.

Popular South African Gold Coins

South African Krugerrands were the first bullion coins to enter the international market, making their first appearance in 1967 as a way for the South African government to promote their gold reserves. Initially, the coins were only produced in 1 troy ounce pieces, but later fractional denominations were added to the series. From 1979 to 1989, other bullion options came available with the introduction of Canada’s gold Maple Leaf, China’s gold Panda, the United States gold Eagle, Austria’s gold Philharmonic, Australia’s gold Kangaroo, and the United Kingdom’s gold Britannia.

Return to the top of the page.

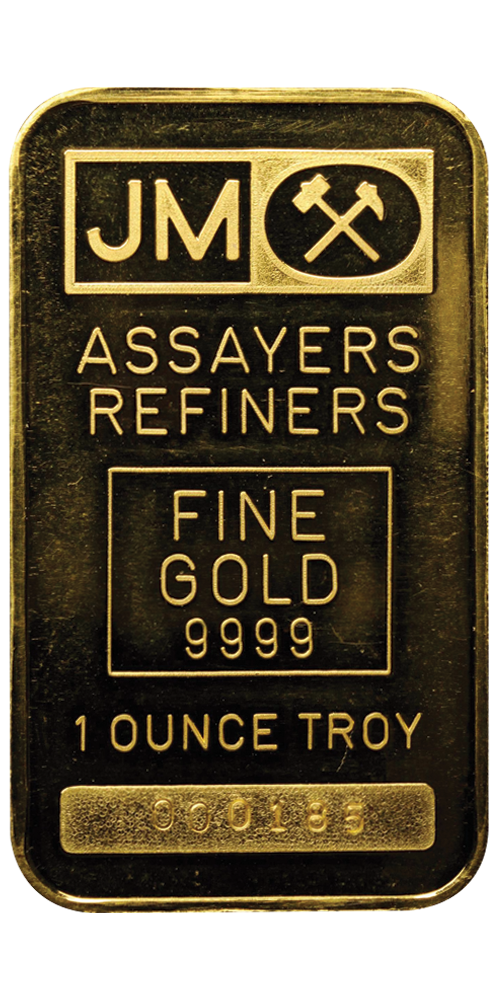

Gold Bars and Ingots

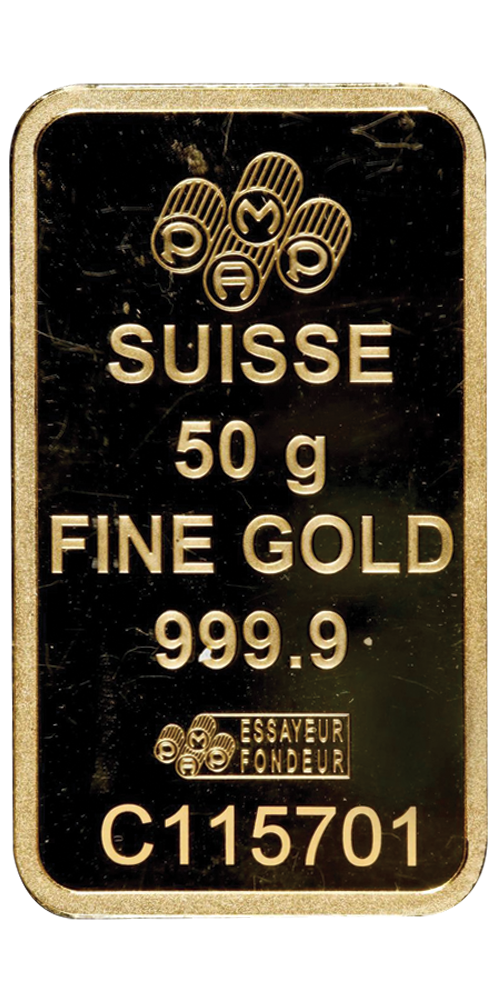

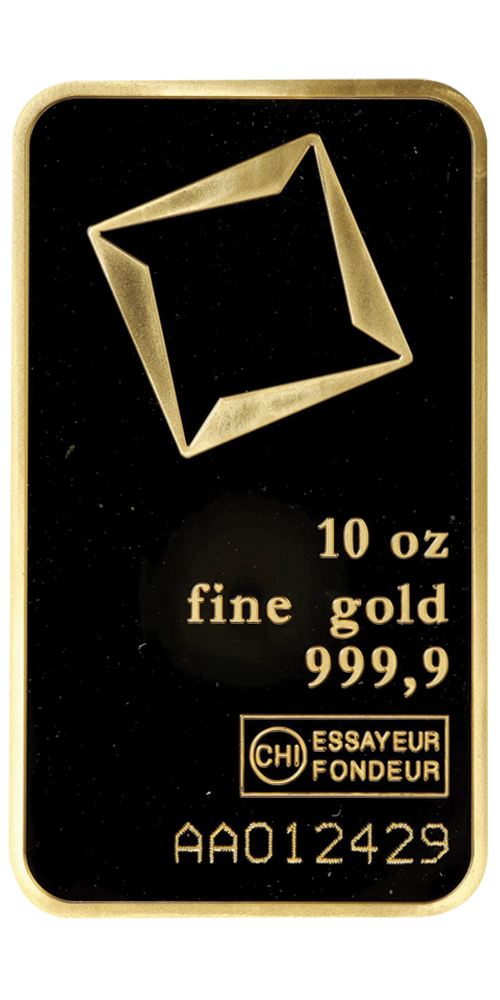

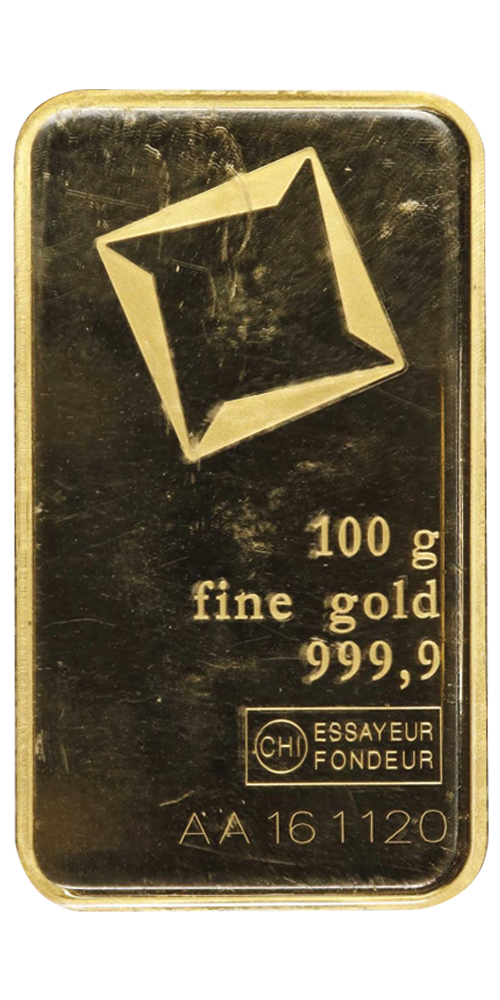

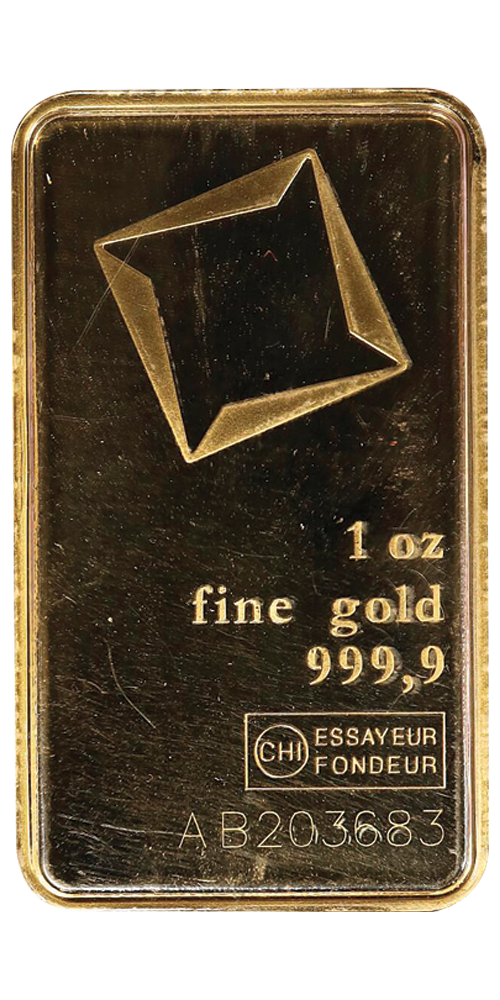

Gold bars offer the greatest variety of sizes and shapes to fit every budget. Minted in amounts from 1 gram to 1 kilogram or more, gold bars are a convenient and affordable way to invest in gold, and are generally traded at lower premiums than gold coins. Most gold bars are produced by reputable private refineries, such as Engelhard, Johnson Matthey, PAMP Suisse or Valcambi. There are a handful of government mints that produce gold bars as well. All gold bars will be stamped with their fineness and the weight of the bar in troy ounces or grams.

Gold bars are normally limited in their design alterations. Since gold bars are intended for investment purposes, rather than collections, the designs do not change from year to year. However, there are still some interesting bars that have been produced. Take for example the CombiBars produced by Valcambi. These bars begin as 1 ounce or 50 gram gold bars. They are divided into individual 1/10 ounce or 1 gram bars so that the buyer can break off increments as needed and therefore subdivide the bar into smaller units. PAMP Suisse produces a similar item.

While it is not typical, there are government mints that produce gold bars. Most gold bars, whether produced by a refiner or a government mint, will be of the utmost purity: 0.9999 fine.

Stack’s Bowers Galleries is happy to help you begin your bullion journey. If you would like to talk to a representative about purchasing gold, email us at info@stacksbowers.com.

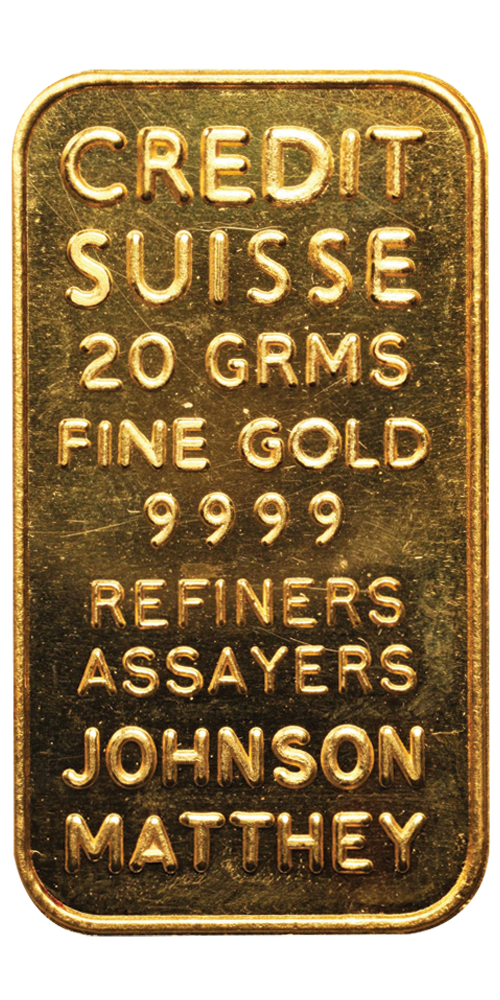

Credit Suisse Gold Bars

As with most gold bullion bars, Credit Suisse bars are almost always found with the same design: a logo or wordmark that identifies the company, the amount of gold, and the purity. Gold bars such as this one are distributed with the target audience of investors instead of collectors. Credit Suisse was founded in Switzerland in 1856 with the purpose of funding the national rail system. However, Credit Suisse grew over time and ended up making its name in the international investment banking arena. Now, Credit Suisse is among the most trusted gold and silver bar distributor. All new bullion items purchased directly from Credit Suisse come with an assay card that verifies the weight, purity and metal content.

Return to the top of the page.

Engelhard Gold Bars

The beginnings of Engelhard date back to the early 20th century, when Charles Engelhard moved from Germany to work for a platinum marketer. He soon formed his own company that focused on platinum and its uses within the dental and jewelry professions. The platinum business grew as the years wore on. By the late 1950s, Engelhard was a well-known and trusted name within the precious metal community. It produces millions of dollars worth of gold and silver bars each year. However, in 2006, the company was acquired for roughly $5 Billion by BASF, a fellow company of German origins. To this day, the Engelhard name remains reliable. Engelhard Industries was praised for their honest dealings, accurate weights, and spot-on purities.

Return to the top of the page.

Johnson Matthey Gold Bars

The firm of Johnson Matthey began in 1817 in London when Percival Norton Johnson set up shop as a gold assayer. George Matthey joined as a partner in 1851, at which point the business became Johnson & Matthey. The firm has served as official assayer and refiner to the Bank of England, and its successor firm of Johnson Matthey is still highly active in the world precious metals marketplace. However, the firm stopped minting bullion bars in the 1980s. An agreement with a Dallas wholesaler has allowed the Johnson Matthey logo to appear on newly minted bars. The company is located in over 30 countries and employs nearly 10,000 people. Johnson Matthey’s refining business has since sold to Asahi.

Return to the top of the page.

Pamp Suisse Gold Bars

Pamp Suisse is a gold, silver, and platinum refiner with origins in Ticino, Switzerland. Founded in 1977, the company is legally known as Produits Artistiques Metaux Precieux, or PAMP for short. This international brand releases a variety of themed gold bars. Among their most popular designs are the Fortuna gold bars, Rosa gold bars, and Lunar gold bars. Pamp Suisse is also recognized for having an array of weights which range from 0.30 grams up to 250 grams on most bars. Another popular design is the 25 gram incremental bars, that allow the buyer to break off 1 gram sections of the bar to create whatever fractional amount is needed. All items from Pamp Suisse are sold with their assay card to insure the weight, purity, and metal content is accurate.

Return to the top of the page.

Valcambi Gold Bars

Valcambi is based in Balerna, Switzerland and was founded in 1961 under a different name. Shortly after its founding, the company was bought by Credit Suisse and was used as a tool to diversify the bullion industry and to bring new products to market. Most of the bars produced by Valcambi are cast gold bars, meaning molten gold is poured into open dies and left to cool. Minted ingots are formed with the help of computer controlled stamps and presses. Much like Pamp Suisses fractional bars, Valcambi created the CombiBars, which are 1 ounce bars that are divisible up to 1/10 ounce. This allows the buyer to divide up the bar to their liking after their initial purchase.

Return to the top of the page.