The year 1980 began with a crash in the precious metals silver market. For years, the price and value of silver had risen and as noted before, some people were hoarding it and trying to corner the market. The price increases induced people to search out silver coins that they had in piggy banks, cookie jars and other places and sell them.

In a short period of time, starting in the late months of 1979, the price of silver dropped dramatically from as high as $50 an ounce to $10 an ounce a few months later. And it threatened to drop even lower. As explained earlier, the Hunt family had bought tons of silver, spending millions of dollars and speculating that the price might go as high as $100 per ounce. They bought more on margin and by the later part of 1979 had created a real bull market in silver bullion. With the constant increase in value, banks and traders worldwide followed their lead and bought and speculated in futures on this market.

When some of the loans became due to the Hunts, they initially covered them. But eventually they and other speculators were unable to provide the necessary cash to cover their loan calls. Panicked selling began and silver flooded the market, causing the price to plummet. The constant calls for cash brought the Hunt family to bankruptcy, as it did many others who bought high and were forced to sell low, with many losing over 70% to 80% of their initial investment.

There was a rumor started that the U.S. Mint or Treasury would start buying silver again and re-stimulate the interest, bringing prices back up. But these rumors were not true. This caused a drop in other markets. Industries that had needed silver and had bought it at high prices, sometimes on contract, were now "stuck" with a devalued asset. Havoc was everywhere.

There were many coin buyers who had profited from the run up in silver prices and some who had started investing in coins as part of the silver speculation. This section of the numismatic market quickly changed and those who had been participating in it either left the hobby, sold their collections, or put them away on a shelf or in the bank to see if the market would go back up.

As you can imagine this was not a great time for numismatics, even though dealing in precious metals was only a small part of the coin collecting hobby. However, all the panic in the metals markets and the ensuing publicity brought about a lapse of interest in collecting "numismatic coins." The entire silver episode that the Hunts had initiated beginning a decade earlier had a major effect on the economy for years to come. Their speculation affected the entire economy.

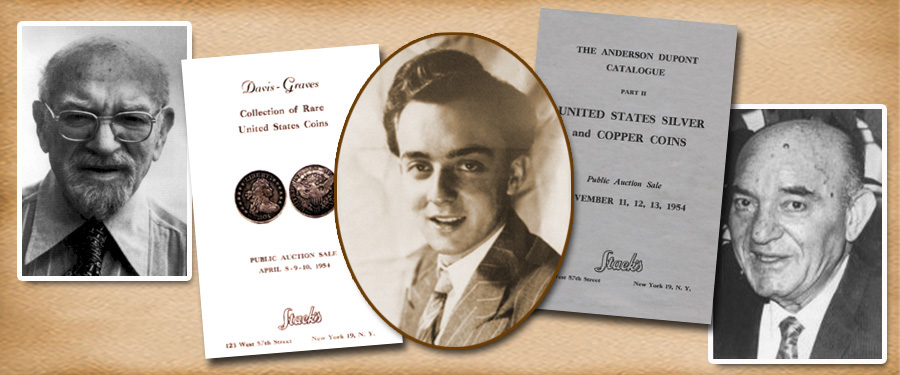

Of course, all of us at Stack’s continued to conduct our numismatic business during this period, buying and selling coins and holding public auctions, although prices were not as high for many things. Due to our longevity in the field and our ability to maintain a large diversified inventory, we were able to serve the collectors who still had capital to buy. Running a coin business during these difficult times was not easy, but luckily we had an established clientele, as well as commitments of consignments already set for 1980.