Harvey Stack loved to tell stories and his favorites were those about his family and the history of Stack’s. While he passed away on January 3 of this year, he had already penned his remembrances through 1999. We believe Harvey would want these articles to be read and enjoyed and so we are pleased to continue the story of his life in numismatics.

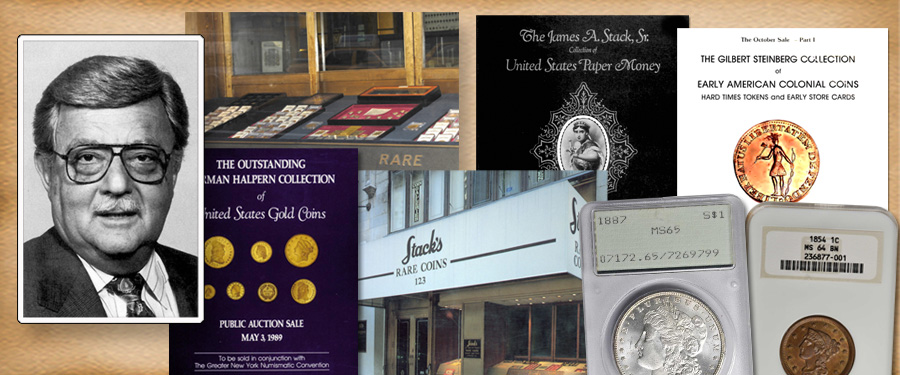

1993 was an important anniversary year for Stack’s as it marked 60 years since Joseph and Morton Stack opened their numismatic retail store in New York City. It was also the 40th anniversary of the opening of the shop on West 57th Street, where the company was located after having expanded and moved a couple of times in the 20 intervening years. Over time, Stack’s, at whatever address, was considered a clubhouse for coin collectors, a place to buy and sell, to meet with fellow enthusiasts, and to use the extensive library the firm had built up over the years. All of us in the Stack family welcomed those who walked through the door, not just as buyers and sellers, but also as fellow numismatists who took the time to teach us what they had learned in their years of collecting.

The numismatic market continued to recover from 1987’s downturn and Stack’s was able to buy a number of collections and help our clients acquire important additions to enhance their collections. Our auction consignments also grew this year and we were able to offer some 10 collections, comprising single owner sales, estate collections, and auctions that brought together multiple consignments that were not large enough to require a dedicated catalog.

One downer on the numismatic market was some unhappiness expressed by collectors of all levels as well as investors about the series of commemorative issues that numbered in the hundreds of thousands and had been sold at premiums far in excess of their precious metal value. These were offered by the U.S. Mint and were sold using promotional material and advertisements that included the phrase "An Investment in the Future." The endorsement of the Mint attracted many who did not fully understand what they were buying. Such buyers often used these products as gifts for family members or friends, thinking that they would be a great investment. But by 1993, when some of these purchasers tried to sell these prizes they had bought from the Mint, the investment turned out to be not so great.

I offer as an example a lovely grandmother who in 1983 responded to the advertising of the U.S. Mint and bought one each, as they were offered, as an investment for her grandson. When in 1993 the grandson need money to go to college, grandma offered to sell the "collection" and give the money to him for his education. She told me that she had invested about $5,000 in what she had, and wanted to sell them to Stack’s. I examined all the coins, some loose, some in cardboard holders, and a few in boxes, and computed what I could pay for them. I knew it would be quite a bit lower than her original cost as gold and silver prices did not rise or fall much during this period and the "coins" would only be worth their current collector value.

I went to the charts we maintained showing the current buying and selling prices, both below her original cost. Using the highest prices quoted in the newsletter we received daily, I was embarrassed to only be able to offer her $2,210. She was stunned — after all to her these were sold to her by the Mint as "investment items." She must have thought I was trying to rip her off, so she gathered her coins together and left the shop. A few days later she returned and asked if my offer was still good. I told her it was. She informed me that she had visited about half a dozen shops around the city and the best offer she received was $2,100, most were less and in general, no one was very interested in buying them at all. I wrote her a check and she thanked me. This was not the first or last time that this happened, and it was a situation that really bothered me. I realized that so many neophyte buyers, gift buyers and even collectors could be misled by the Mint and its salesmanship. I felt that the hobby and professional dealers like Stack’s would lose more collectors due to these new issues than would be gained.

This was so upsetting to me that I sought help to see what could be done. Over the course of my career, I had gained experience dealing with the government as well as working within various organizations to make changes that would benefit the hobby. From bringing action against the Treasury to stop import restrictions on gold to advising on the Hobby Protection Act I had the opportunity to campaign for the benefit of numismatics. I had worked with the ANA on grading standards and served on the board of the Professional Numismatic Guild (PNG) as well as acting as its president. My appointment to the 1976 United States Assay Commission (the last one convened) also gave me some contacts within the government and the Mint.

Stack’s had a good client and friend in Jimmy Hayes, who was a representative to Congress from Louisiana during this period. I discussed the entire matter with him and asked if he could offer any guidance to reach the right official at the Mint and explain the "special issue " situation and my concerns. He said he would do what he could. A few months later, Jimmy told me that he could arrange for me and others to appear before the House of Representatives Banking and Finance Committee. He said it might take a year to get this hearing, but it would be done, and the matter would be heard by a higher authority. As it was not my first time dealing with the government, I was not surprised to hear that it would take time, but I felt I had found a way to get my message across.