Looking forward to 1988, we did not anticipate the changes that were before us, as several happenings took place a few months before the New Year, and other events occurred after the year started.

The numismatic market had its ups and downs starting in late October right into the new year 1988, yet the drop in value related more to the modern issues which depended on the values of precious metals. Interest also decreased in the newer U.S. Mint products, as well as items from many newer series.

Collectors who were focused on more classical issues struck prior to the Second World War, found that these either retained their value or dropped only a bit. These collectors generally bought coins because they enjoyed owning them and therefore often chose not to put them up for sale in a declining market. In times where it was difficult to sell, they retained their coins for a better day.

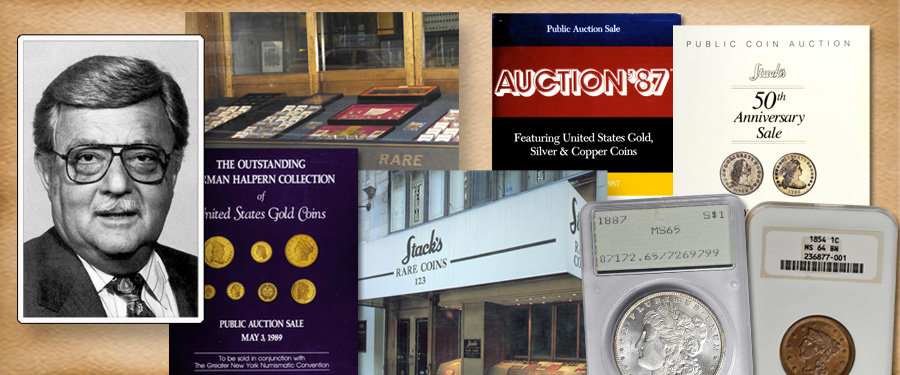

Stack’s had a dozen sales during 1988, including the renowned large cent collection of Herman Halpern, the Frank Springle Collection of U.S. Gold and Silver Coins, the Herbert Oechsner Collection of Colonials, selections from the Gilbert Steinberg Collection, a New England Museum Collection, and the Charles Kramer Collection of Rare U.S. Gold, as well as a number of specialized collections. These consignments came primarily from collectors that we had worked with for decades, helping them to acquire what they needed for their collections. Some collectors did choose to sell, while other consignments were from estates or their families. Many came to us as a way of thanking us for working with them. We, of course, were thrilled to be remembered.

As it had in previous years, the ongoing attempt to standardize the grading of coins continued to have a strong effect both on collectors and the hobby. After World War II, growth in collecting and the large influx of new people meant that it was easier to take advantage of those who had little knowledge. This resulted in a great deal of counterfeiting and doctoring of coins, as well as using grading to “con” those who didn’t know any better. Over the decades the government as well as the ANA and other hobby groups had worked to improve this situation and had made strides in that direction. With authentication services, grading standards and, eventually, third-party grading, things in the hobby had improved, although there were always people who found ways to work around these efforts.

By 1988, both PCGS and NGC were up and running, and they were attracting more and more submissions all the time. ANACS (the grading service of the American Numismatic Association) was also grading coins. People could feel more confident about the items they were buying. As noted, there was abuse of this system as well, with people cracking out their coins and resubmitting them in hopes of getting a higher grade, and thus increasing the value of their pieces. Even with this supposed “objective” grading, those of us at Stack’s still played an important role as professional numismatists, as we had the ability to look beyond just the grade on the holder and offer opinions on the other factors that made a coin desirable or not. Overall, the addition of third-party grading would be a big help to the industry, although there were problems that arose over the years.

There were other areas of the hobby where buyers and sellers, especially new or uninformed collectors could be taken advantage of.

Due to an Act of Congress in 1985, the Mint started to make and sell gold and and silver coins in 1986 (with face values far below the precious metal value of each “coin”). They gave the gold eagle a weight of one ounce of gold, with a face value of $50, when the gold value was more than $360 at the time. The one-ounce silver eagle had a face value of $1, although the metal was worth about $10. There was no clear information about why the Mint decided to do this as it could be confusing to those who were buying the items.

The Mint offered these eagles to the public at a premium above face value, advertising the “coins” as an “investment in the future.” They were marketed through some dozen distributors, who also made a profit on their original cost.

The face value/precious metal value was not clear to everyone in the marketplace, but the fact that the Mint was involved in the selling gave confidence to those who were making purchases. This created an opportunity for unscrupulous people to use this confusion in the market to add to their own bottom line.

In addition, many counterfeits hit the marketplace, both from here as well as from overseas. False "plastic holders" were used that featured inflated grades that artificially raised the value of the item in the container. Smaller dealers and “Mom and Pop” shops bore the brunt of the damage from these scams. Doctored, improperly marked coins flooded the market, promoters used large ads in local papers to sell investment “opportunities,” even using the sales pitches of the United States Mint. This caused great concern to the average public buyer and to those of us who made our living in the business.

All the above led to some destabilization of the market and drew in the Secret Service (Treasury Agents), the Federal Trade Commission (FTC) and the Security Exchange Commission, (SEC). Each of these agencies had only small staffs to attack the problem. The FTC did have some agents who successfully stopped some of the activity but needed more direction from their director to stop these offenses. In 1988 and on into the next year 1989 the Director of the FTC challenged our industry in order to try to put in place rules and regulations to address these problems.

The numismatic market had some real "bumps" to overcome during these times that will be further discussed in my next story about Numismatic Growing up in 1989.